Senior Trump administration officials said Saturday that there were indicators that Iran intended to use conventional missiles against the U. S. and allies in the region while President Trump weighed a strike. Weijia Jiang reports.

Salsanis Analytics

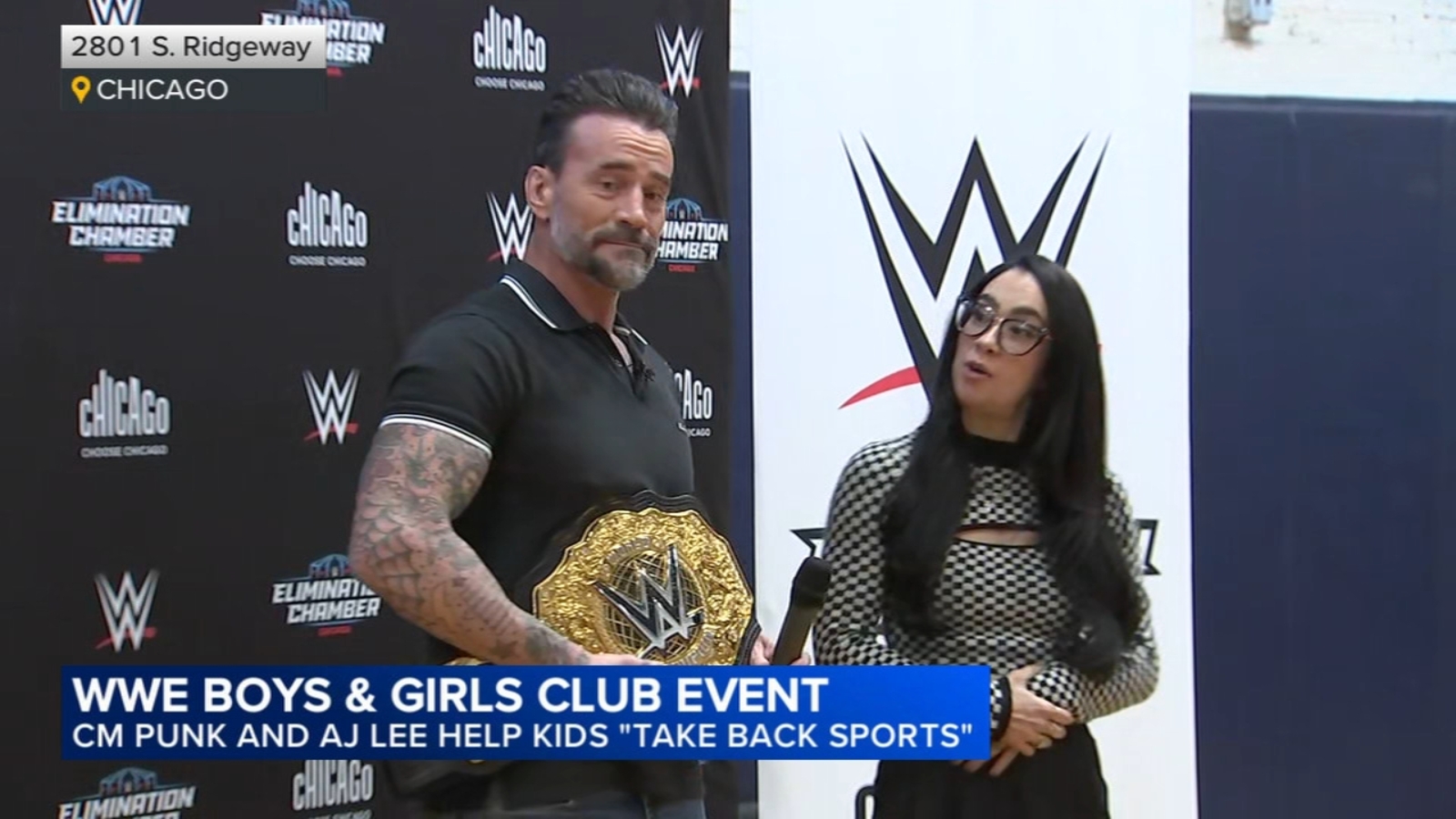

WWE stars CM Punk and AJ Lee helped kids “Take Back Sports” at a Boys & Girls Club and ESPN event on Friday in Chicago.

Nearly four weeks into the investigation of Nancy Guthrie’s disappearance, the main crime scene is being turned back over to the family. Jonathan Vigliotti reports.

For the first time in history, both the men and women’s USA hockey teams took home Olympic gold. As Jonah Kaplan reports, they had very different homecomings.

A Bakersfield man was arrested this month in connection with his girlfriend’s death in an alleged domestic violence case.

“We’ve had a few documented bobcat sightings over the last several years, much like this week’s sighting-a bobcat, minding its own business, simply passing through a property,” said Dedham Animal Control. The post Greater Boston town issues guidance after bobcat sighting appeared first on Boston. com.

Several players at positions of need for the Patriots are rumored to be trade candidates in the coming weeks. The post 5 possible trade targets for Patriots outside of Maxx Crosby, A. J. Brown appeared first on Boston. com.

Democratic Gov. Wes Moore of Maryland and Jared Polis of Colorado were at the White House on Friday after President Trump initially excluded them from a bipartisan governors meeting. CBS News’ Fin Gómez has more.